The rise of diamond prices

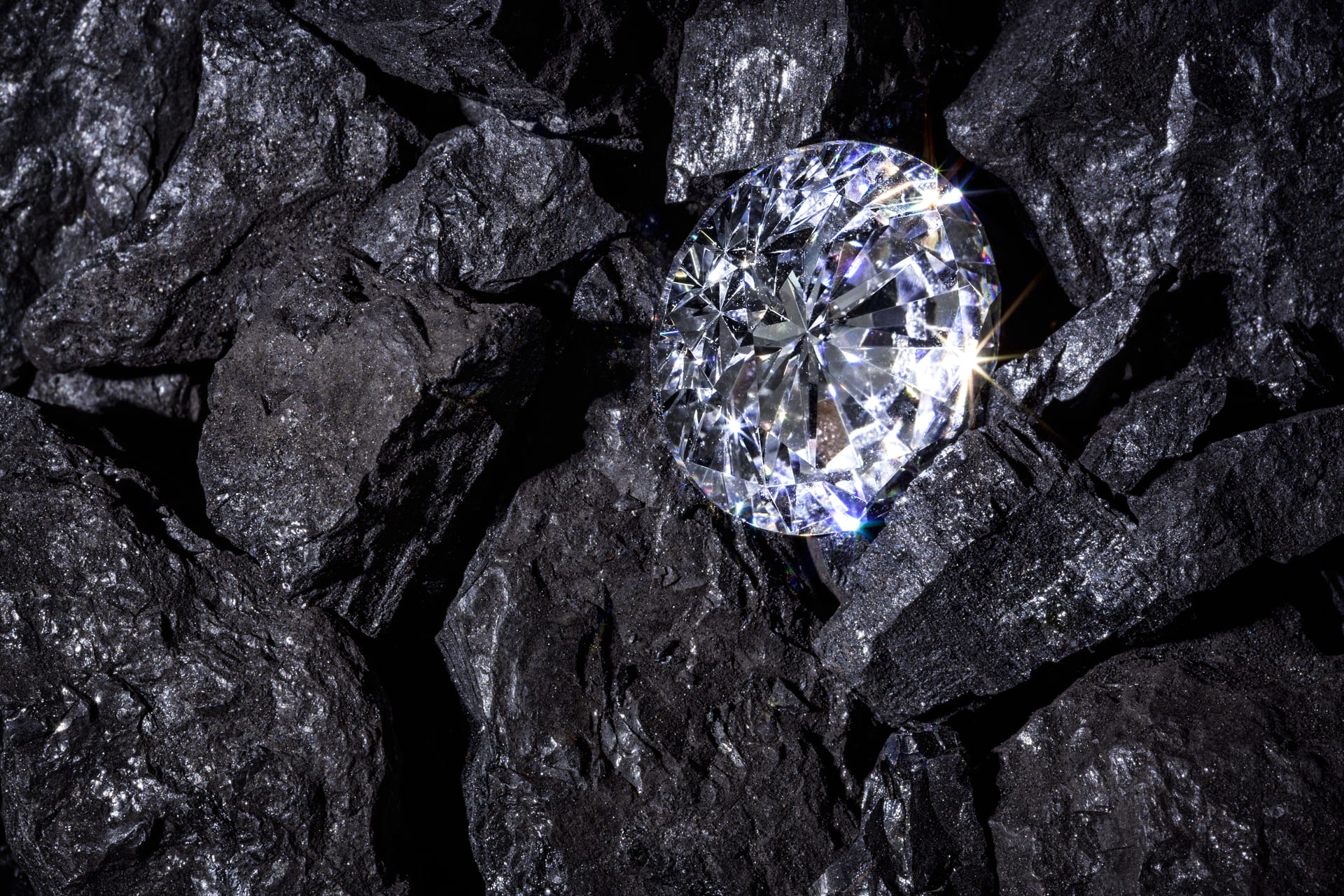

Diamond is an extremely rare material. Formed at depth under exceptional conditions, rough diamonds come to the surface through the earth's crust, notably during volcanic eruptions. They are then moved and dispersed by rainfall runoff and rivers, sometimes to the bottom of the ocean. So many specific circumstances and constraints are required for this mythical stone to form and reach the surface of the Earth, that its very existence is largely a matter of chance. This singularity makes diamonds the most expensive natural material known and an inalterable refuge value.

This stone represents luxury par excellence. Combining rarity, beauty and purity, it is endowed with all the values intrinsic to luxury objects. And the price level of rough and cut diamonds has always been on the rise: for the past hundred years, the price of diamonds has been rising steadily by 2 to 3% per year. To top it all off, this stone is also a luxury accessible to almost everyone, while remaining a rare and sublime acquisition in the life of every couple. In other words, every woman in love has her share of diamonds and they all have the whole dream. Rough diamonds come in all weights and qualities, so they are available at all prices. After estimation and grading, diamonds are cut, classified and certified by carat weight, colour, clarity and cut quality. Our website i-diamants offers a diamond price catalogue and a collection of solitaires, rings, wedding rings, pendants... in gold and platinum, all made to measure with the diamond of your choice. On request, we can also estimate the value of diamonds in your possession and propose a buy-back and/or recutting price offer.

If the mines do not last forever, the diamond price increases will be real

Diamonds are forever, but their deposits are not. No natural resource lasts forever, and this already scarce stone is becoming increasingly rare. As value is strongly linked to scarcity, the price of rough diamonds is likely to rise in the next few years, especially if global demand continues to grow, with China, Russia and soon Africa all booming.

Before the global financial crisis of 2008, the United States accounted for 40% of global diamond demand. Since the crisis, the share of demand from emerging countries has increased tenfold. Sales are exploding in China and India, whose consumption will soon account for almost 30% of the market share by 2020, on a par with the United States, whose share has fallen. This will result in a 6% annual increase in global demand, or 247 million carats.

Diamond production is expected to peak this year, 2019, after which it will start to decline gradually. It is estimated that global production will decline by 1% to 2% per year until 2030. And a decline in mining capacity would necessarily result in a sharp rise in the price of diamonds as they become increasingly scarce in the 21st century.

The Argyle mine in Australia is scheduled to close in 2020. Its annual production of 14 million carats represents about 10% of the world's total annual diamond production and the mine is a dominant player in the coloured diamond market. And many other mines around the world are also expected to be exhausted by 2035.

This mismatch between supply and demand will inevitably cause prices to soar.

New diamond resources to explore to avoid scarcity?

Canada has become a strategic player in recent decades. In particular, Gahcho Kué, the world's largest new diamond mine in the last 13 years, went into commercial production in 2017. Located 280 km northeast of Yellowknife, near the Arctic Circle, the mine is expected to produce approximately 54 million carats of rough diamonds over its 12-year life. The mine secures Canada's position as one of the world's leading diamond producers. The opening of the mine is important for Canada's diamond industry, as it should be able to offset declining production at the country's other two major diamond mines: Diavik and Ekati.

Angola and other less explored parts of Africa will also help offset the decline of many existing mines. In particular, the African kingdom of Lesotho could help offset the production shortfall in other countries, as well as in relatively unexplored areas of Russia.

But the investment required to develop these new deposits can often outweigh the return. Diamond exploration is very difficult, and the "easiest" sites have already been thoroughly explored. Now the search is shifting to places that are much harder to access (deeper or more remote) or to places that were previously inaccessible for political reasons. Who knows if tomorrow new mines will be found and the risk of scarcity eliminated?

A sudden or gradual rise in prices on the diamond market?

However, it is a long way from the mine to the jeweller's window. After extraction, rough diamonds must be processed, sorted and sold. Then they are cut, certified and marketed by a very large and dispersed network of diamond dealers to jewellers around the world who set them in their jewellery. This multiplicity and diversity of players, the length and density of the value chain and the absence of a single price, encourages a progressive evolution of the diamond market. The real consequences of the drop in production will not be felt until retailers have to tell consumers that a type of diamond is no longer available and that there is no substitute stone close to the buyer's criteria. That said, gradual price inflation is always good, not only for the industry, but also for buyers. Indeed, slightly rising prices underline the value proposition of diamonds.

As long as there is love, there will be a desire for a diamond to seal a union. And more and more women are becoming emancipated and buying diamond jewellery for themselves. In recent decades, diamonds have also become an increasingly popular safe haven for diversifying investments. This stone will always have value while being disconnected from currencies, states and economic conditions. A new demand coming from China, India, Russia and other emerging countries suggests a growth of a market, estimated today at 60 billion dollars. The diamond has not finished making talk about its timeless beauty, its exceptional properties, and the evolution of its price "linear or exponential"?

To understand the criteria for estimating the price of a diamond, it is important to learn about the famous 4C's that make up the value of a stone: Carat, Cut, Colour, Clarity.

De Hantsetters, diamonteers since 1888

Customer service at your service, provided by diamond dealers

All our diamonds are independently certified by 3 world-renowed organisations

Want to talk to a diamonteer ?

Contact us now